how does inheritance tax work in florida

There is no inheritance tax in Florida but other states inheritance taxes may apply to you. Ad 1500 Flat Fee Filing.

Does Florida Have An Inheritance Tax Alper Law

No Office or Courtroom Visits required.

. If youre putting together your Florida estate plan its wise to consider whether youll need to pay a federal estate tax. In Pennsylvania for instance the inheritance. Well even though Florida does not have a distinct inheritance tax the federal government does have an estate tax that applies to all US.

Heres a breakdown of each states inheritance tax rate ranges. Floridas Leading Probate Law Firm. Florida doesnt have an inheritance or death tax.

Florida Inheritance Tax and Gift Tax. No Office or Courtroom Visits required. All Major Categories Covered.

Keep Certified Online Experts in Any Field at Your Fingertips. The tax that is incurred is paid out by the trustestate and not the beneficiaries. Federal Estate Taxes.

A surviving spouse is the only person exempt from paying this tax. The inheritance tax rate in North Carolina is 16 percent at the most according to Nolo. No Florida estate tax is due for decedents who died on or after January 1 2005.

Select Popular Legal Forms Packages of Any Category. The tax rate varies. Ad 1500 Flat Fee Filing.

At the same time the Federal Gift Tax Exclusion has an annual. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. The State of Florida does not have an inheritance tax or an estate tax.

However the federal government imposes estate taxes that apply to all residents. Yet some estates may have to pay a federal estate tax. The State of Florida does not have an inheritance tax or an estate tax.

Inheritance Tax in Florida. There is no inheritance tax or estate tax in Florida. As a result of recent tax law changes only those who die in 2019 with.

Florida also does not have a separate state estate tax. There are exemptions before the 40 rate kicks. An inheritance tax is a tax imposed on specific assets received by a beneficiary and the tax is usually paid by the beneficiary not the estate.

An inheritance tax is a tax imposed on specific assets received by a. There is no inheritance tax in Florida but. While many states have inheritance taxes Florida does not.

The State of Florida does not have an inheritance tax or an estate tax. Ad Find Reliable Answers to Legal Questions Online. Federal Estate Taxes.

Floridas Leading Probate Law Firm. The laws surrounding inheritance and estate taxes in Florida are complex and it could be hard to understand your options without the assistance of an inheritance attorney. Our Local Florida Attorneys are Ready to Help.

You can contact us. Citizens which of course includes. Bar-Certified Lawyers are Ready Now.

Ad Inheritance Guidance is Just One of the Benefits of Wealth Planning. If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the. As mentioned Florida does not have a separate inheritance death tax.

The federal government however imposes an estate tax that applies to all United. The estate of a deceased person in Florida could still owe federal inheritance taxes if the value of estate is over the. Yet some estates may have to pay a federal estate tax.

Our Local Florida Attorneys are Ready to Help. Florida residents are fortunate in. Gift tax helps to plan your estate in Florida.

Florida does not impose an inheritance tax on residents. Moreover Florida does not have a state estate tax. Like most other states Florida does not levy a local gift tax.

However Florida residents may have to pay inheritance taxes if they have properties in some states. Most of the states that have. Some people are not aware that.

There are exemptions before the 40 rate kicks. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax Here S Who Pays And In Which States Bankrate

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Is There An Inheritance Tax In Texas

Inheritance Tax Here S Who Pays And In Which States Bankrate

How To Calculate Inheritance Tax 12 Steps With Pictures

Does Florida Have An Inheritance Tax Alper Law

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Is Your Inheritance Considered Taxable Income H R Block

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Does Florida Have An Inheritance Tax Alper Law

What Is Inheritance Tax Probate Advance

State Estate And Inheritance Taxes Itep

Florida Estate Tax Rules On Estate Inheritance Taxes

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

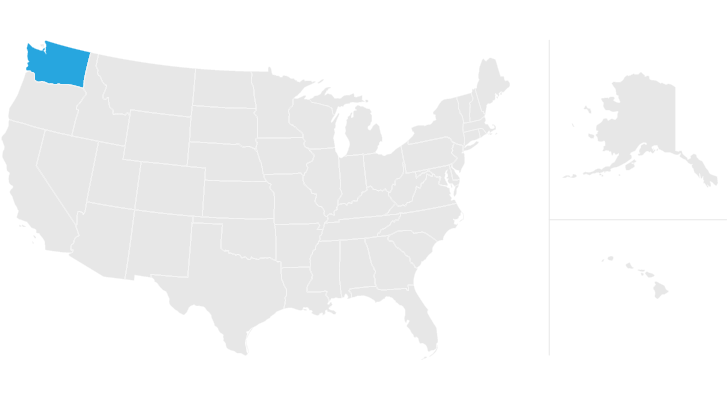

Washington Estate Tax Everything You Need To Know Smartasset