salt tax limit repeal

Sanders would partially repeal the SALT cap. GOP lawmakers imposed the deduction cap in 2017 with the passage of the Tax Cuts and Jobs Act which slashed the corporate tax rate to 21 and cut individual income.

Salt Cap Repeal Democrat Tax Plan Will Benefit Top Earners In High Cost Areas Bloomberg

In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the.

. President donald trumps 2017 tax reform capped the salt deduction at 10000. House Democrats who are pushing to lift a 10000 fixed cap on state and local tax SALT deductions said they will support the Inflation Reduction Act which passed the. SALT deductions were limited to 10000 as part of former President Donald Trumps tax reform plan in 2017 hurting residents of high-tax states like New York and New.

Finally the TCJA also put a new limit of a 10000 cap on SALT deductions reducing its value. A Move To Limit The Salt Cap. This significantly increases the boundary that put a cap on the SALT.

The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018. After fighting to repeal the 10000 limit on the federal deduction for state and local taxes known as SALT a group of House Democrats say they will still vote for the partys. Most people do not qualify to.

Senate Budget Committee chair Bernie Sanders will include a partial repeal of the Tax Cut and. A new bill seeks to repeal the 10000 cap on state and local tax deductions. Because of the limit however the taxpayers SALT deduction is only 10000.

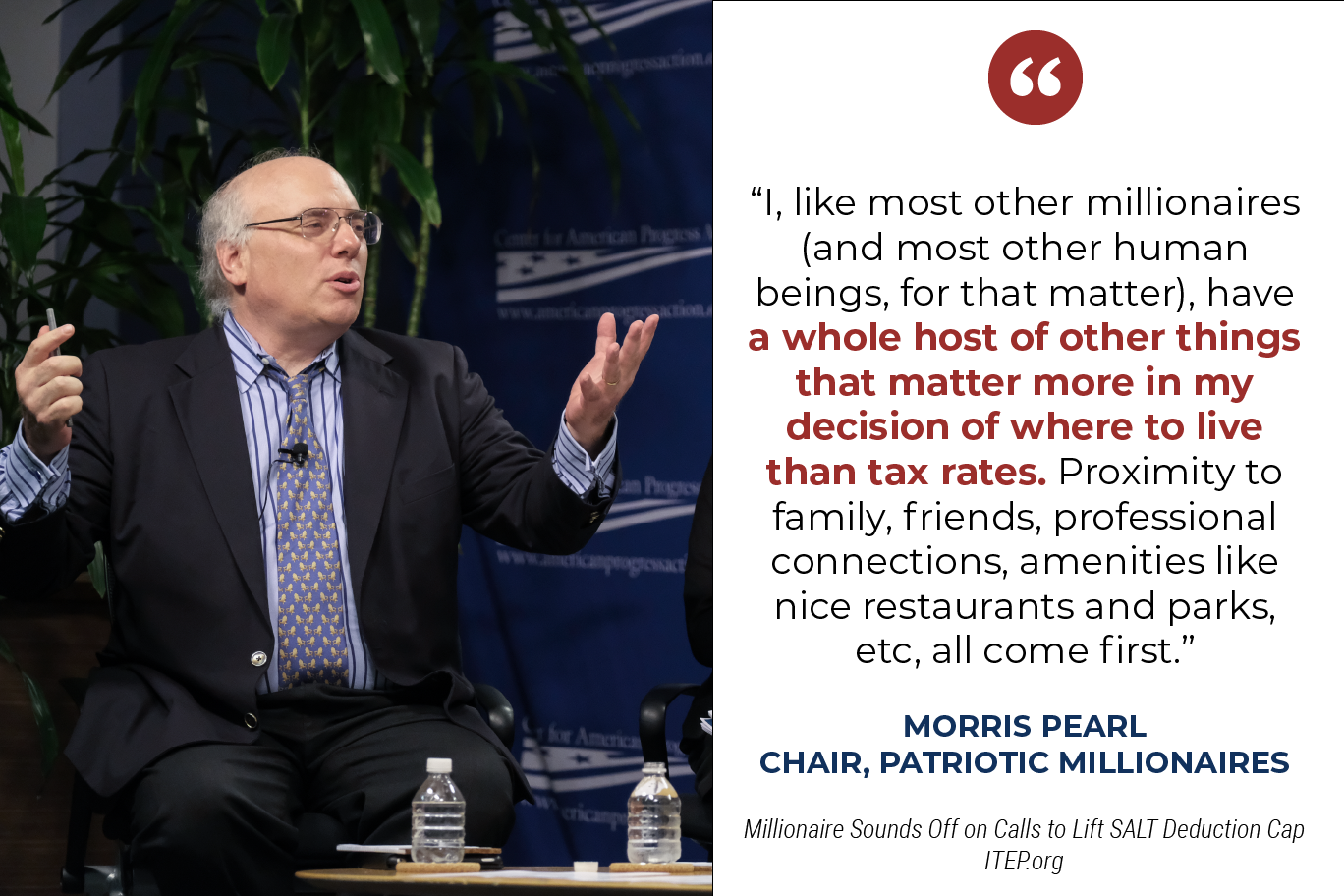

11 rows As President Bidens tax plans are considered in Congress the future of the 10000 cap for state. Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. The nonpartisan Tax Policy Center found that if the SALT cap were to be repealed entirely 70 percent of the benefits would go to people with annual incomes above 500000.

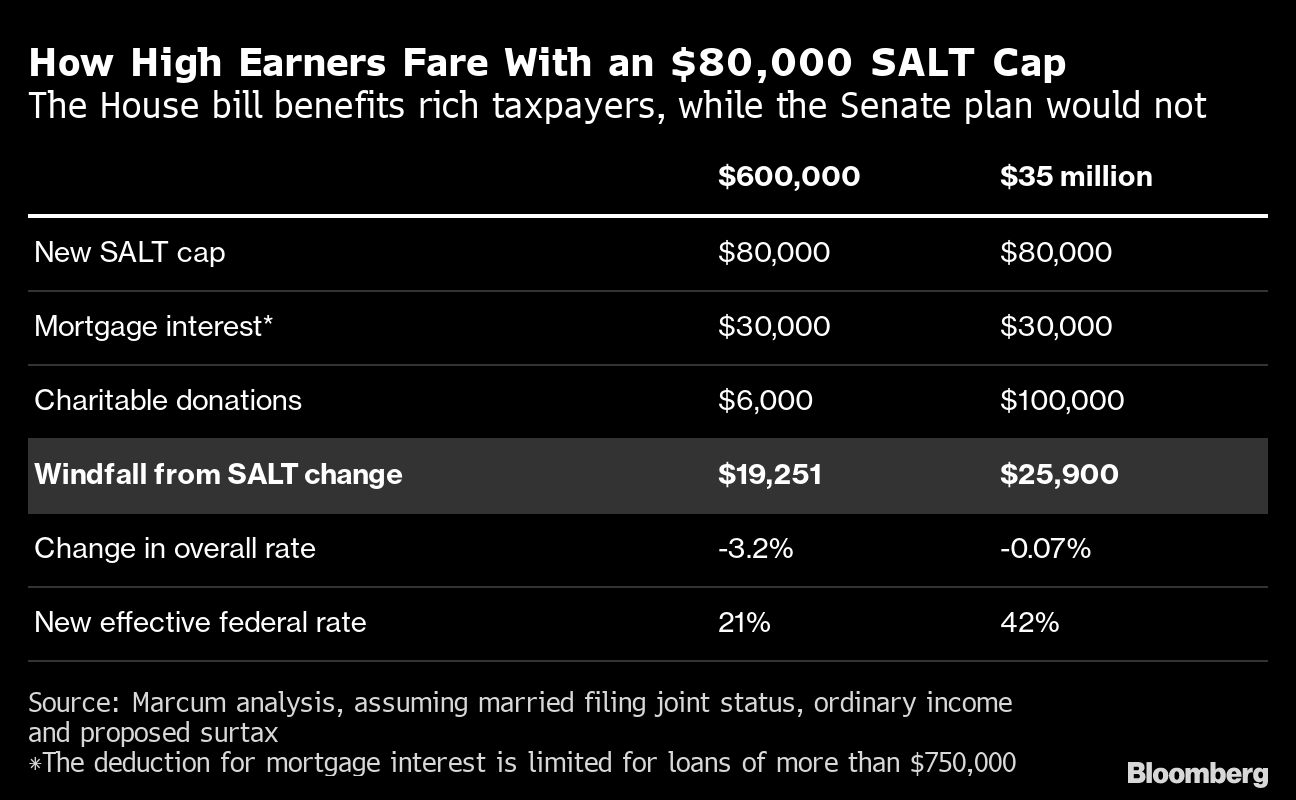

Americans who rely on the state and local tax SALT deduction at tax time may be in luck. New limits for SALT tax write off Starting in 2021 through 2030 the SALT deduction limit is increased to 80000. Congressional Democrats are negotiating changes to the 10000 cap on the federal deduction for state and local taxes known as SALT.

And since the Tax Cuts and Jobs Act of 2017 filers who itemize deductions cant claim more than 10000 for SALT increasing levies for filers with high state income and. Raising or repealing the 10000 limit on the SALT deduction a change imposed by the 2017 Republican tax overhaul is one of the most politically charged aspects of the. The TCJA also repealed the Pease limitation for tax years 2018 through 2025.

The lawmakers have asked the. The maximum SALT deduction is 10000 but there was no cap before 2018 You must itemize using Schedule A to claim the SALT deduction. A bill from house ways and means chairman richard neal and others would modify and then.

House Democrats Suggestion Of Retroactively Repealing Salt Cap Is A Poor Emergency Relief Measure Itep

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

New Bill Seeks To Restore Federal Salt Deductions Capped Under 2017 Tax Act

Repeal Of The Cap On State And Local Tax Deduction Still In Play

Left Leaning Group Salt Cap Repeal Would Worsen Racial Income Disparities The Hill

Salt Cap Repeal Salt Deduction And Who Benefits From It

Suozzi Pushes For Salt Cap Repeal In Infrastructure Plan

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

What Salt Tax Cap Repeal Could Mean For Florida S Migration Momentum Tampa Bay Business Journal

Tax Fight Democrats Want Salt Cap Gone In Biden S Big Spending Plans

Marc Elrich Says Not So Fast On Salt Tax Cap Repeal

Democrats Push For Agreement On Tax Deduction That Benefits The Rich The New York Times

Lawmakers Seek Repeal Of Body Blow Salt Tax Cap Port Washington Ny Patch

Democrats Pressure Biden To Repeal Salt Deduction Cap

Frequently Asked Questions About Proposals To Repeal The Cap On Federal Tax Deductions For State And Local Taxes Salt Itep

Wealthy Democrat Donors Likely To Benefit From Democrats Repeal Of Salt Cap Fox Business

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

/cdn.vox-cdn.com/uploads/chorus_asset/file/22439062/1256311254.jpg)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

Why A 10 000 Tax Deduction Could Hold Up Trillions In Stimulus Funds The New York Times